SAP FI/CO specialists – who are they, how do they work and what are their plans?

In the world of SAP, it is FI/CO, i.e. financial and controlling modules, that form the foundation of many implementations. They are the basis for accounting, cost control, reporting and planning in most companies operating on SAP. But what exactly can specialists who work in these areas do? How do they develop and what are their expectations regarding their work?

Who are SAP FI/CO consultants?

Among all respondents surveyed by Awareson in its annual SAP labour market survey, those working in FI and/or CO modules constitute one of the largest and most diverse groups.

Like the entire community of SAP consultants in Poland, FI/CO specialists are a relatively young but experienced professional group. Although their age does not differ significantly from that of other consultants, they stand out with a more mature professional profile.

The most numerous group is aged 30–39 (38%), which coincides with the dominant age range in the entire SAP population (approx. 43%). There are more than average numbers of people aged 40–49 (31%) and over 50 (14%), with a smaller proportion of younger experts under 30 (17% compared to 20% overall).

There is also a slightly higher proportion of women among FI/CO specialists – 27% compared to less than 26% in the entire SAP community. Some of them came to the world of SAP from the finance side – as many as 29% of FI/CO specialists have experience as key users, which is slightly higher than the average for all consultants (27%).

The vast majority of SAP FI/CO consultants have a university degree:

• 70% hold a university degree,

• 27% have completed postgraduate studies or a doctorate,

• 3% have secondary education.

The most popular fields of study are:

• Finance, accounting, economics – 35%,

• IT and technical fields – 33%,

• Economics and related fields – 26%.

This clearly shows that the FI/CO area is at the intersection of three worlds – finance, IT and business.

Competencies

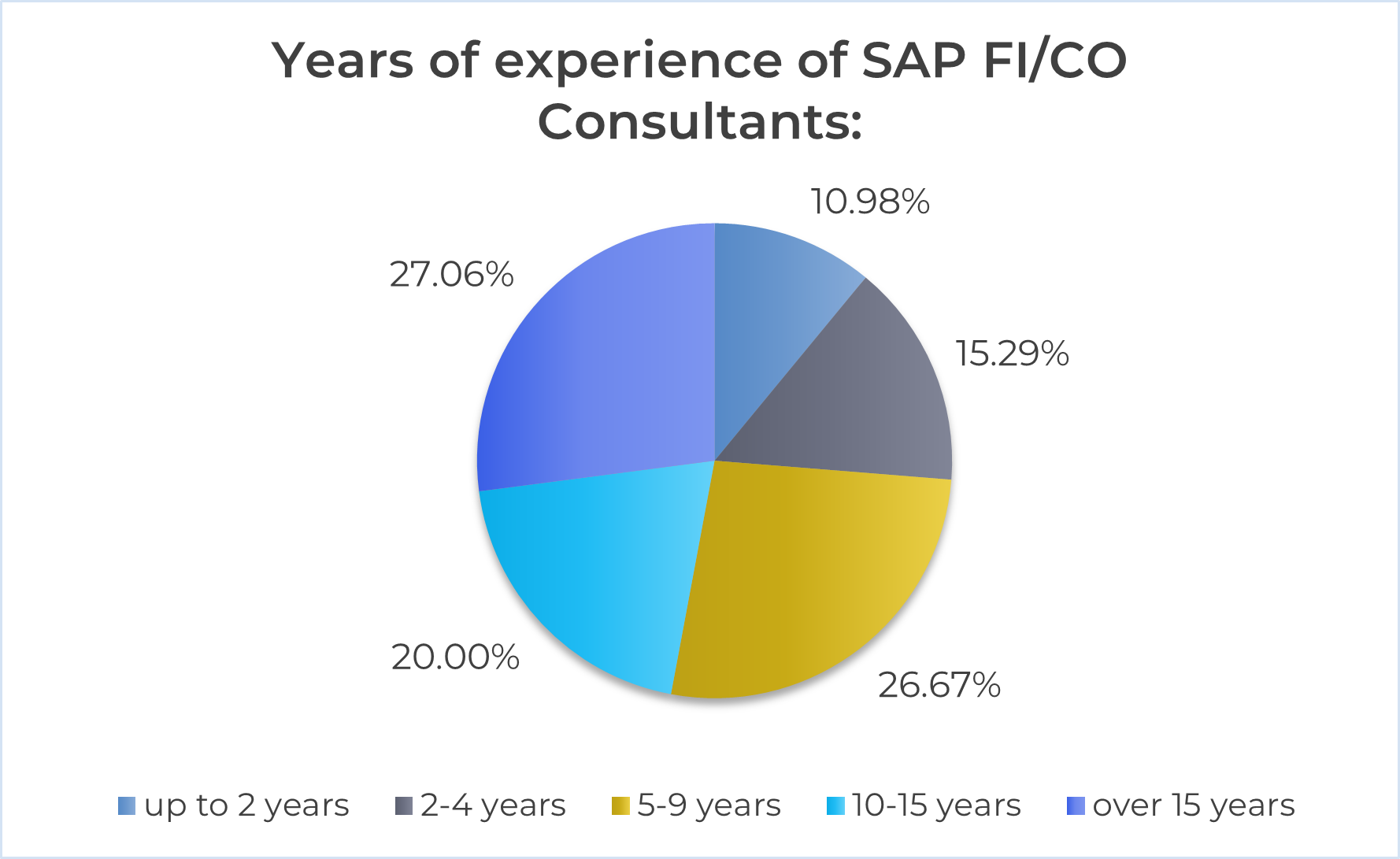

SAP FI/CO specialists are one of the most experienced groups in the entire SAP ecosystem. Statistically, they have longer professional experience than consultants for other modules. There are slightly fewer people with less than two years of experience (approx. 11%) than in the entire SAP community (nearly 13%). Similarly, specialists with 2-4 years of experience account for 15% compared to 21% overall.

On the other hand, the share of consultants with 10-15 years of experience is slightly higher (20% compared to 19%), and as many as 27% of FI/CO specialists can boast over 15 years of experience – significantly more than the average for the entire group (approx. 20%).

FI/CO consultants must also constantly develop their skills. Changing tax laws and regulations mean that their knowledge needs to be constantly updated. It is not only a matter of technology, but also of understanding local legal and accounting conditions, which are key when working with SAP financial modules.

The most important sources of knowledge used by FI/CO specialists are primarily daily professional practice (62%) and internal training and exchange of experiences with other consultants (23%). Official SAP documentation is used by 12% of respondents, and industry forums and SAP groups by 11%. Only 2% of specialists indicate external courses and certificates. Interestingly, studies are not seen as a key source of knowledge, which confirms the practical, project-based nature of learning in the SAP world.

For FI/CO consultants, knowledge of languages is not only an asset, but often a necessity:

• 100% of respondents know English,

• 52% know German,

• 30% know at least one other foreign language.

Knowledge of German is particularly useful in projects carried out for clients from the DACH region (Germany, Austria, Switzerland), where SAP FI/CO systems are closely integrated with local financial legislation.

SAP modules – what else besides FI/CO?

Regardless of the market situation, demand for their skills is stable and high, and has now increased further due to the implementation of KSeF. Experts in the area of Record to Report (RTR) and people who are able to look at the SAP system holistically – understanding not only the financial part, but also its business context and interactions with other modules, e.g. sales – are particularly sought after.

In practice, FI/CO consultants often work at the intersection of finance, logistics, sales and HR – especially in areas requiring the integration of processes and controlling data. Twenty-nine per cent of them declare knowledge of SAP MM, and 28% are proficient in SAP SD. Increasingly, FI/CO experts are also expected to understand the full picture of business processes and the ability to collaborate between modules – this, as the expert emphasises, is what distinguishes the best consultants from those just starting their careers.

Forms of employment and earnings

The SAP environment can be divided into two distinct worlds – consulting and employment on the end customer side. In the first case, project work dominates, often in a freelance model or in partner companies, focused on system implementations and integrations. The second area is primarily the development, maintenance and improvement of existing SAP solutions within the organisation.

The forms of cooperation among FI/CO specialists are diverse, although still quite traditional – more than half (55%) work on an employment contract, 46% on a B2B contract, and about 5% on a contract of mandate or a contract for specific work. FI/CO is an area that often involves long-term support for the company and handling of ongoing financial processes, which explains the large share of employment contracts. However, the B2B model is growing in strength, especially for complex implementations or migrations to S/4HANA.

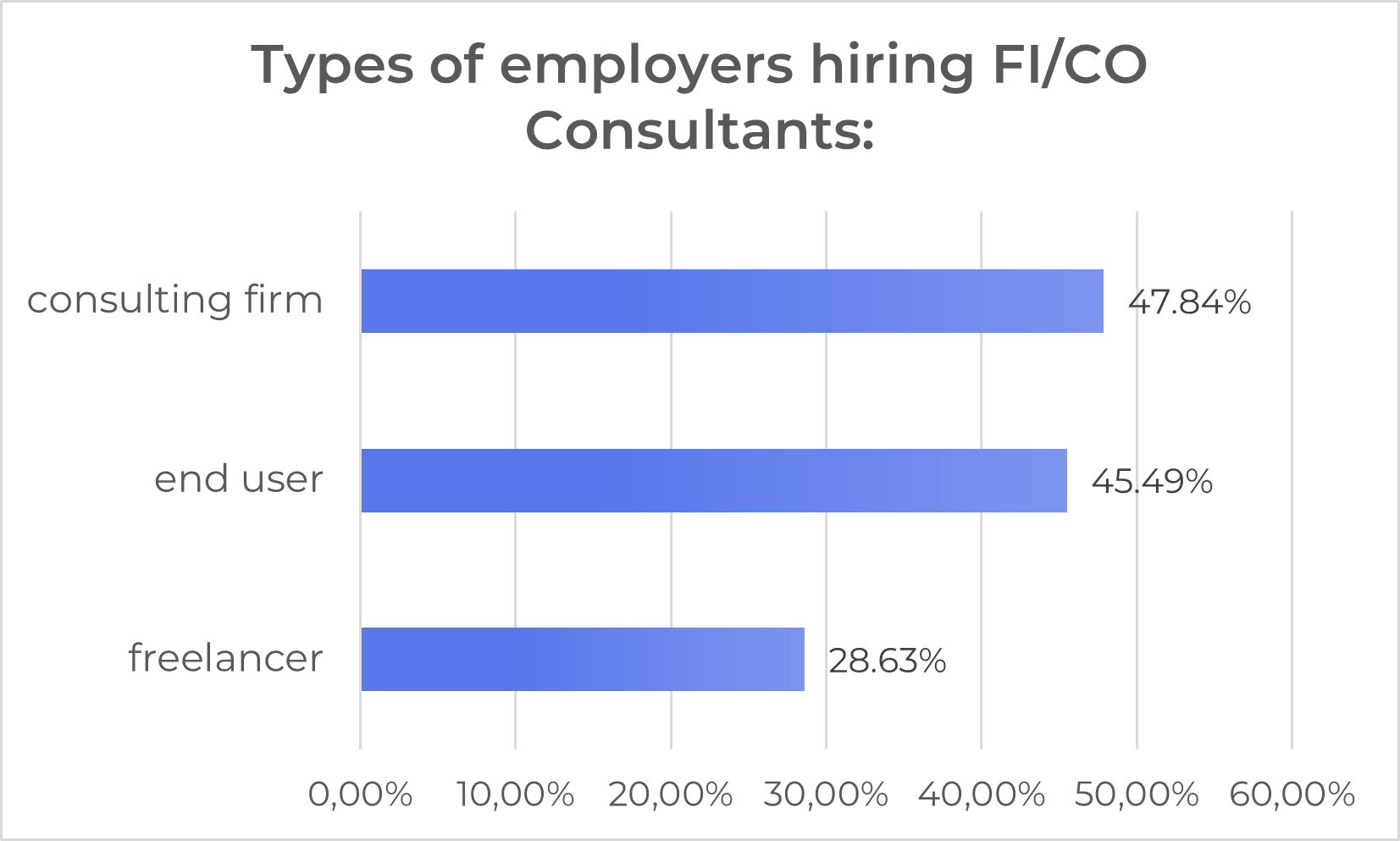

Nearly 49% of FI/CO consultants are employed by consulting firms, which is similar to the level among the entire SAP community. Over 45% work on the end customer side (slightly more than the industry average of 43%), and 29% work as freelancers, which is also higher than the overall group of respondents (approx. 24%).

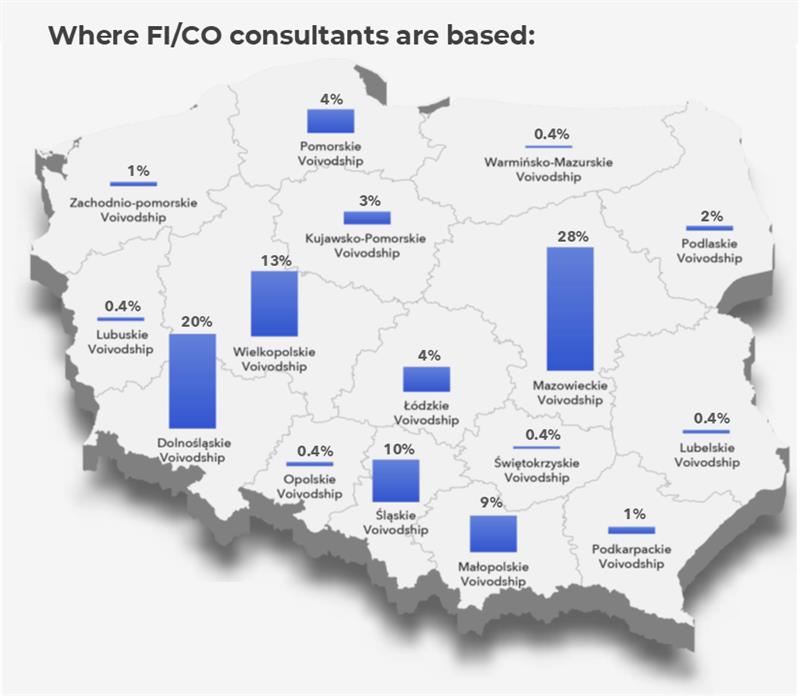

Most FI/CO consultants work in the provinces of Mazovia (28%) and Lower Silesia (20%), followed by Greater Poland, Silesia and Lesser Poland. This distribution is not accidental – it is in these regions that the largest number of consulting companies and SAP service centres are located, and in the west of the country there are also many manufacturing companies that make intensive use of SAP solutions, especially in the area of finance and controlling.

Earnings

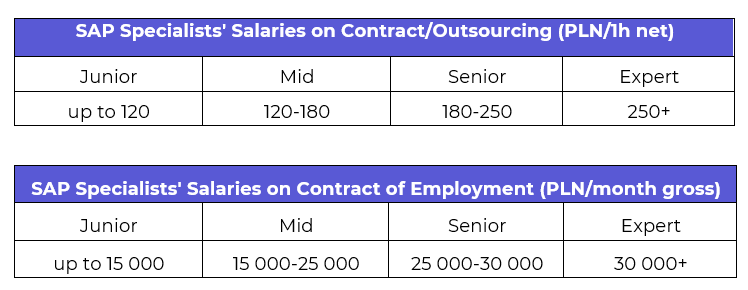

According to the report ‘The SAP Specialist Market in Poland 2025–2027’, FI/CO consultants most often earn PLN 180–250 net per contract and approximately PLN 18,000–25,000 gross per employment contract. 52% of respondents are satisfied with their remuneration.

Rotation

Among SAP FI/CO specialists, turnover remains at a moderate level. In the coming 12 months, 21% of consultants declare their willingness to change jobs, 52% do not yet have specific plans, and 27% do not intend to take any steps in this direction. This means that a large part of the market remains in a phase of observation – ready to move if an attractive offer arises.

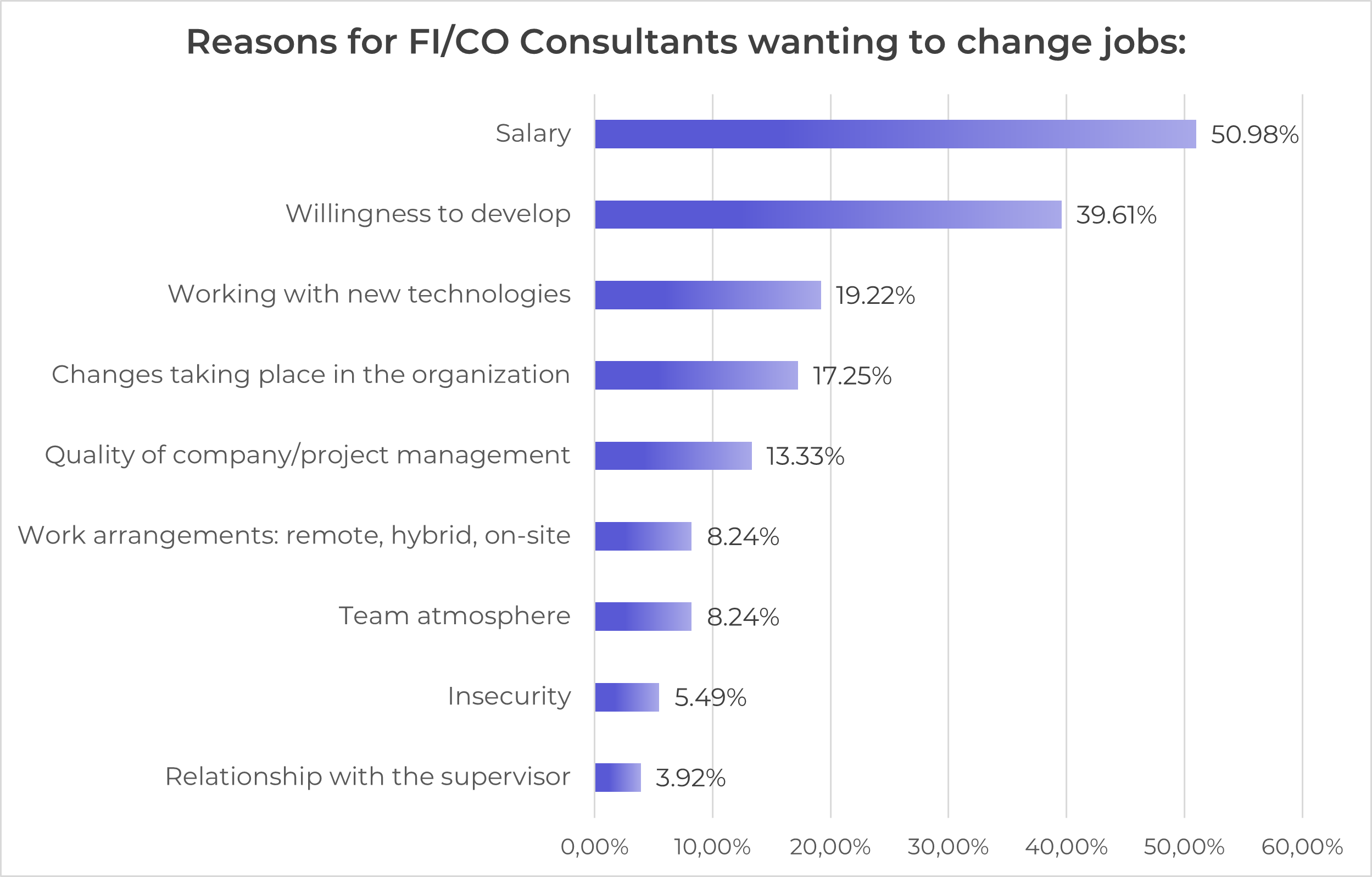

The most frequently cited reasons for changing jobs are remuneration (51%) and the desire for professional development (40%). FI/CO consultants are eager to get involved in new implementations, especially projects based on SAP S/4HANA, cloud solutions and international initiatives. They are attracted to tasks that require a broad view of the system and a real impact on the shape of business processes. Development and implementation projects are much more attractive to them than maintenance work, which offers fewer opportunities for competence development.

There is also a noticeable seasonality in the turnover of FI/CO consultants. The most changes occur at the beginning and end of projects – usually in January and June, when contracts lasting from six to twelve months are launched or terminated. During these months, companies’ recruitment activity and consultants’ willingness to change jobs increase significantly. Outside these periods, turnover is lower and the market is more stable. Experienced specialists rarely actively seek new employment – they often have subsequent contracts planned in advance, even before the end of their current projects.